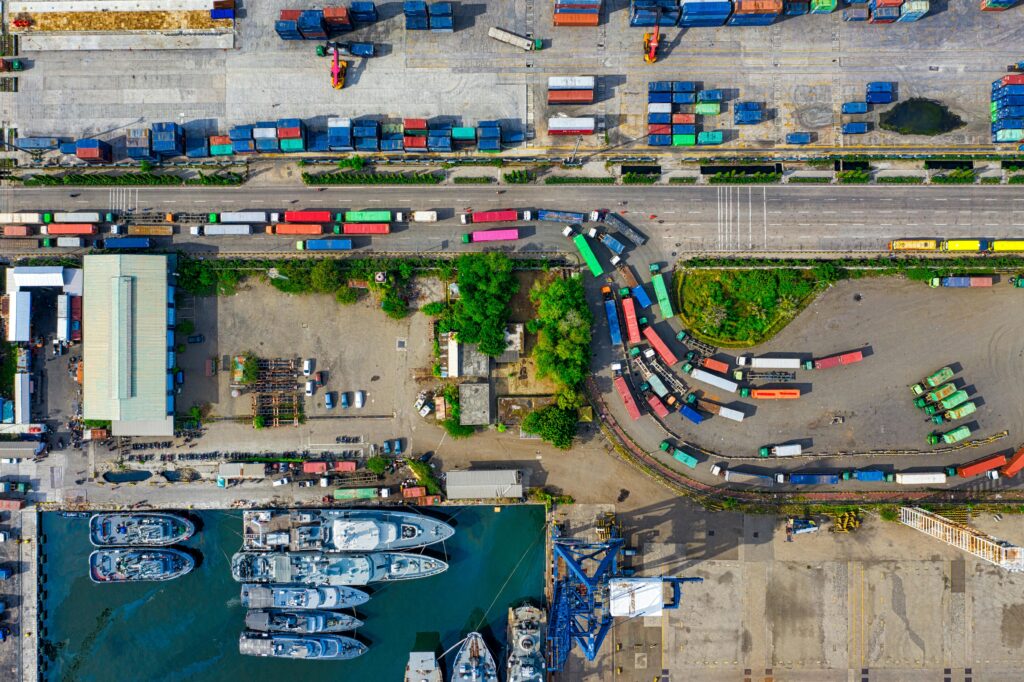

Transportation & Logistics

to receive the latest research in this sector

At a Glance

Meliora Advisory’s Transportation & Logistics practice offers sell-side M&A advisory to asset-light and asset-intensive operators across freight, last-mile, 3PL, and specialty transport sectors. We’re known for helping founder-led and family-owned businesses navigate the complex buyer landscape, especially in high-fragmentation markets. Most of our clients are selling for the first time often after decades of building and we guide them through a structured process that’s grounded in sector knowledge and buyer strategy. The result: less noise, more fit, and maximum value at the finish line.

Who We Serve

Focused on Founders, Built for Outcomes

3PL & Tech-Enabled Logistics

Advanced logistics solutions powered by real-time data, smart automation, and efficiency.

Warehousing & Distribution

Storage, inventory, and fulfillment services built for dynamic modern supply chains.

Last-Mile Delivery

Final-leg logistics services tailored for speed, convenience, and broad customer reach.

Asset-Based Transportation

Freight solutions backed by reliable owned fleets and extensive nationwide delivery capacity.

Recent Reports

Signal Over Noise

Could You Exit Without Breaking Your Business?

7 Key Documents In Any M&A Deal

Notable Transactions

Outcomes That Speak for Themselves

Acquisition of

Sky Transportation Services acquired by Warehouse Services

Buyside Advisor

*Includes engagements where Meliora’s principals were involved while affiliated with other firms; logos shown for identification only, no endorsement implied.

Have a Question? We’re Here to Help.

Questions? Ideas? We’re all ears.